Nevai Torres

REALTOR® | CA DRE# 02189708

(559) 777-3377

Nevai Torres

REALTOR® | CA DRE# 02189708

(559) 777-3377

Is this the year to buy a home?

Is this the year to buy a home?

The answer is YES!

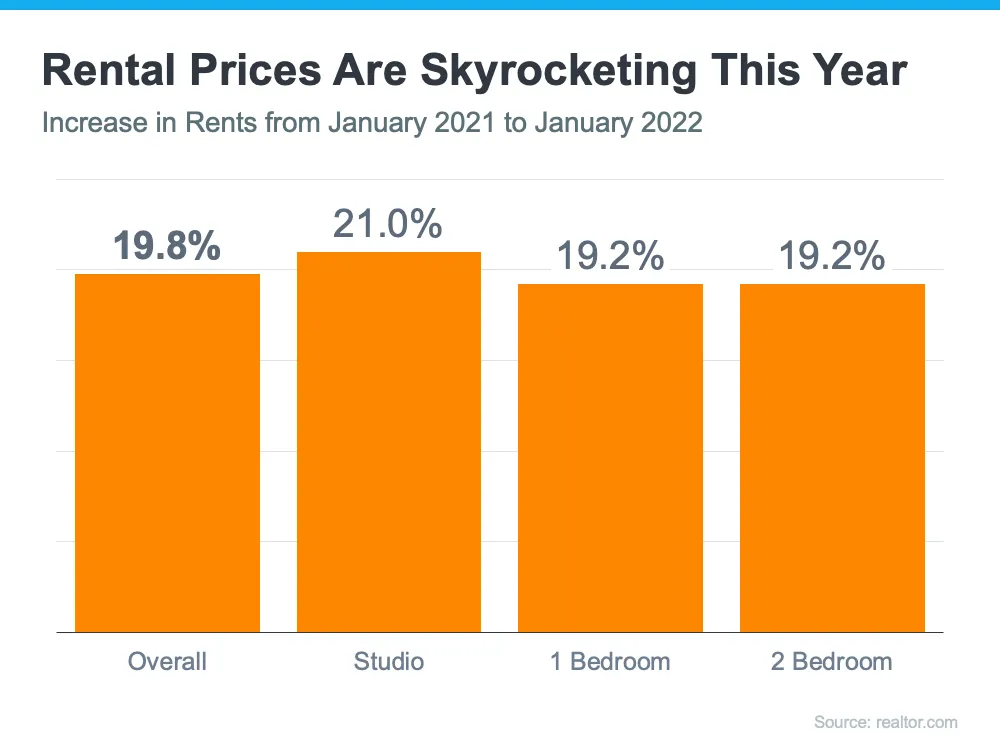

Every year, many renters ask themselves the same question: Should I continue renting, or is it time to buy a home? If you’re a renter, chances are you’ve asked yourself that question at least once, and it’s likely because you’ve faced an increase in your monthly housing costs over time. After all, according to Census data, rents have risen consistently for decades.

To make an informed and powerful decision, the first step is understanding what’s happening in today’s housing market so you can determine which option is the better long-term financial decision for you.

Homeownership

Are Going Up

Again This Year

If you’ve given even a casual thought to selling your house in the near future, this is the time to really think seriously about making a move. Here’s why this season is the ultimate sellers’ market and the optimal time to make sure your house is available for buyers who are looking for homes to purchase.

The latest Existing Home Sales Report from The National Association of Realtors (NAR) shows the inventory of houses for sale is still astonishingly low, sitting at just a 2-month supply at the current sales pace.

What You Need To Budget for When Buying a Home

Here are a few things experts say you should plan for along the way

Down Payment

As you set your savings goal for your purchase, your down payment is likely already top of mind. And, like many other people, you may believe you need to set aside 20% of the home’s purchase price for that down payment – but that’s not always the case. The National Association of Realtors (NAR) says:

“One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership. Having this knowledge is critical to know what to save . . .”

The good news is, you may be able to put as little as 3.5% (or even 0%) down in some situations. To understand your options, partner with a trusted professional who can go over the various loan types, down payment assistance programs, and what each one requires.

Earnest Money Deposit

Another item you may want to plan for is an earnest money deposit. While it isn’t required, it’s common in today’s highly competitive market because it can help your offer stand out in a bidding war.

So, what is it? It’s money you pay as a show of good faith when you make an offer on a house. This deposit works like a credit. You’re using some of the money you already saved for your purchase to show the seller you’re committed and serious about their house. It’s not an added expense, it’s just paying some of that up front.

Work with a real estate advisor to understand any requirements in your local area and what they’ve recommended for other buyers in your market. They’ll help you determine if it’s something that could be a useful option for you.

Closing Costs

The next thing to plan for is your closing costs. The Federal Trade Commission (FTC) defines closing costs as:

“The upfront fees charged in connection with a mortgage loan transaction. …generally including, but not limited to a loan origination fee, title examination and insurance, survey, attorney’s fee, and prepaid items, such as escrow deposits for taxes and insurance.”

Basically, your closing costs cover the fees for various people and services involved in your transaction. NAR has this to say about how much to budget for:

“A home costs more than just the sale price. For example, closing costs—which make up about 2% to 5% of the home’s purchase price—are a major added expense…Lenders provide a Closing Disclosure at least three business days prior to closing on a mortgage. But buyers will need to budget for these added costs ahead of time to avoid sticker shock days before closing.”

The key takeaway is savvy buyers plan ahead for these expenses so they can come into the process prepared.

What You Need To Budget for When Buying a Home

Here are a few things experts say you should plan for along the way

Down Payment

As you set your savings goal for your purchase, your down payment is likely already top of mind. And, like many other people, you may believe you need to set aside 20% of the home’s purchase price for that down payment – but that’s not always the case. The National Association of Realtors (NAR) says:

“One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership. Having this knowledge is critical to know what to save . . .”

The good news is, you may be able to put as little as 3.5% (or even 0%) down in some situations. To understand your options, partner with a trusted professional who can go over the various loan types, down payment assistance programs, and what each one requires.

Earnest Money Deposit

Another item you may want to plan for is an earnest money deposit. While it isn’t required, it’s common in today’s highly competitive market because it can help your offer stand out in a bidding war.

So, what is it? It’s money you pay as a show of good faith when you make an offer on a house. This deposit works like a credit. You’re using some of the money you already saved for your purchase to show the seller you’re committed and serious about their house. It’s not an added expense, it’s just paying some of that up front.

Work with a real estate advisor to understand any requirements in your local area and what they’ve recommended for other buyers in your market. They’ll help you determine if it’s something that could be a useful option for you.

Closing Costs

The next thing to plan for is your closing costs. The Federal Trade Commission (FTC) defines closing costs as:

“The upfront fees charged in connection with a mortgage loan transaction. …generally including, but not limited to a loan origination fee, title examination and insurance, survey, attorney’s fee, and prepaid items, such as escrow deposits for taxes and insurance.”

Basically, your closing costs cover the fees for various people and services involved in your transaction. NAR has this to say about how much to budget for:

“A home costs more than just the sale price. For example, closing costs—which make up about 2% to 5% of the home’s purchase price—are a major added expense…Lenders provide a Closing Disclosure at least three business days prior to closing on a mortgage. But buyers will need to budget for these added costs ahead of time to avoid sticker shock days before closing.”

The key takeaway is savvy buyers plan ahead for these expenses so they can come into the process prepared.

Nevai Torres

REALTOR® | CA DRE# 02189708

Meet Your Agent

Greetings everyone, it’s an honor to have the opportunity to assist those in the Central Valley in purchasing or selling a home. I am a vibrant Latina mother and daughter. I’m aware that it’s an enormous step forward, and sometimes frightening to be able to purchase or sell a home. I’m here to make the experience a more joyful and less stressful process for you. Most of all I’m here to share this experience with you at your convenience. Thank you.

Our Team Would Like The Opportunity To

Help You Buy Your Home

We do more than help people buy homes. We solve problems. We create solutions. We connect the dots. We are the space between where you are and where you are going.Many agents think their most important job is satisfying the customer. We believe that satisfying the customer is simply the MINIMUM requirement for staying in business. We work constantly to improve our systems, processes, and services to go well-beyond the standard level of service provided by most agents.

We want to make sure you are so satisfied with your real estate experience that you gladly refer us to your friends and family. We are truly looking forward to working with you.

Who You Work With Matters

Experience The Park Place Difference

Our Closing Coordinator

Ensures that the hardest and most stressful part of the sales process is buttoned up and stress - free.

A Constantly Growing 27+ Person Team

Ensures that the hardest and most stressful part of the sales process is buttoned up and stress - free.

In-House Full Time Transaction Coordinator

Ensures that the hardest and most stressful part of the sales process is buttoned up and stress - free.

Let's Get Started

Nevai Torres

REALTOR® | CA DRE# 02189708

Meet the Agent

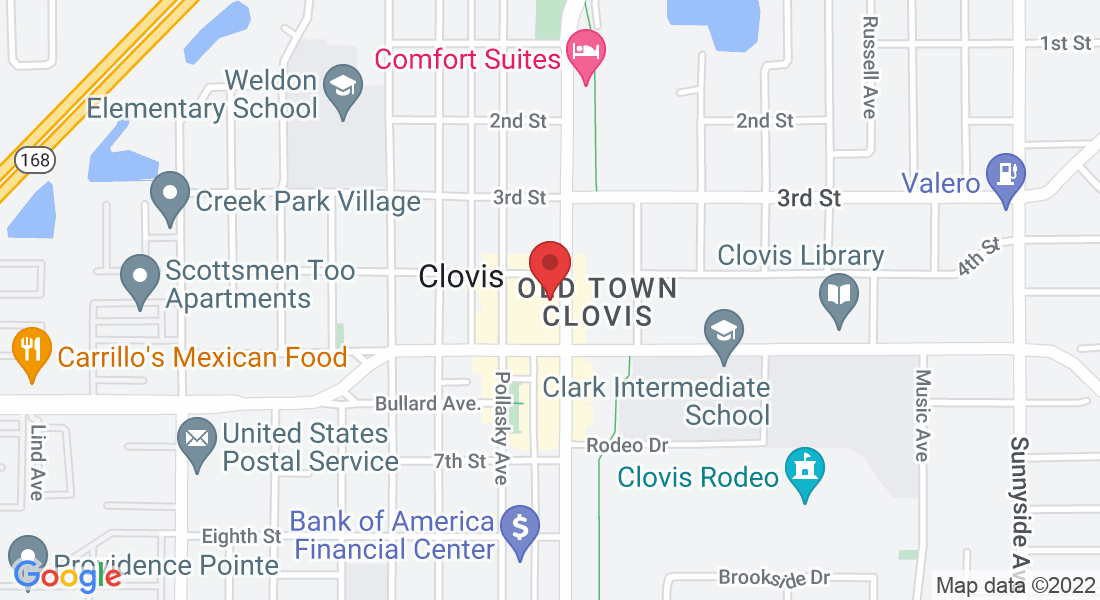

More Homes In Your Area

3 Bedroom / 2 Bath

Clovis Area Home

3 Bedroom / 2 Bath

Clovis Area Home

3 Bedroom / 2 Bath

Clovis Area Home

Infographic data based on https://cdn.nar.realtor/sites/default/files/documents/2021-01-realtors-confidence-index-02-19-2021.pdf

©2021 Copyright Creative Elements Marketing. Park Place Real Estate CA DRE LIC #02104118

Copyright 2022 Park Place Real Estate, CA DRE LIC #02104118 and Nevai Torres, Realtor® CA DRE LIC 02189708. Powered by CEM

" A hero can be anyone. Even a man doing something as simple and reassuring as putting a coat around a young boy's shoulders to let him know the world hadn't ended."

- Bruce Wayne

STEP 1

Praesent semper, lacus cursus porta, feugiat primis in luctus ultrice tellus potenti.

STEP 2

Feugiat erat a ipsum viverra, vel finibus est bibendum. Praesent commodo dolor a lorem.